It’s not just real estate—it’s regulated care.

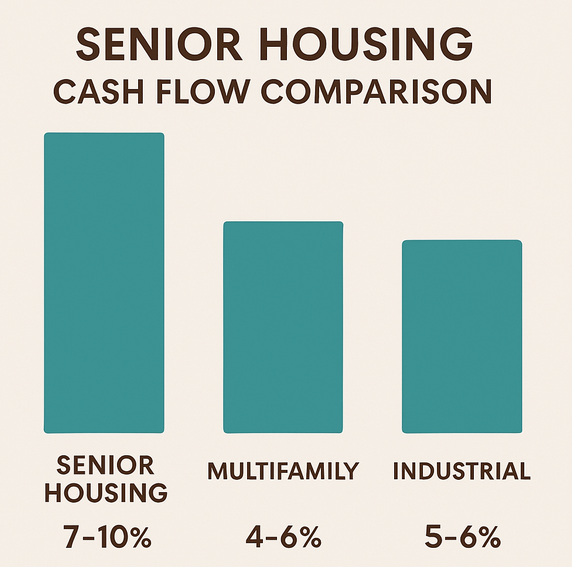

Senior housing is one of the most compelling real estate sectors for long-term investors. It blends demographic tailwinds with income-generating assets. But it’s also unlike any other asset class—and with that uniqueness comes distinct risks.

Understanding these risks doesn’t mean avoiding the sector. It means knowing what to look for, mitigate, and monitor so you can invest wisely.

Regulatory Risk

Unlike multifamily or industrial assets, senior living communities are highly regulated. Assisted living, memory care, and skilled nursing facilities must comply with:

State-level health regulations and inspections

Licensing requirements for staff and facilities

Safety, staffing, and emergency protocols

Potential federal oversight (especially skilled nursing)

Mitigation tip: Partner only with operators that have a strong compliance record and experience navigating inspections.

Labor Market Pressure

Senior housing is labor-intensive. Communities need caregivers, nurses, aides, and administrators. Staffing challenges can lead to:

Increased labor costs

Burnout and turnover

Reduced quality of care

Lower resident satisfaction and occupancy

Mitigation tip: Invest with groups that emphasize caregiver recruitment, training, and retention strategies—especially in a tight labor market.

Operator Failure

Great real estate can underperform due to poor operations. A weak operator can cause:

Occupancy to plummet

NOI to shrink

Regulatory penalties or even closure

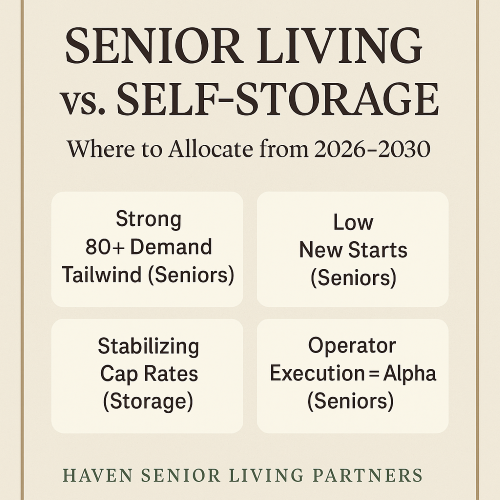

Unlike self-storage or NNN retail, senior housing is operations-heavy. The operator matters just as much as the real estate.

Mitigation tip: Vet the operator’s experience, historical performance, and leadership team before investing. Haven only partners with high-performing, transparent operators.

Insurance Costs and Litigation Risk

Because care is involved, the sector faces higher insurance premiums and litigation exposure compared to traditional real estate.

General liability and professional liability insurance is more expensive

Frivolous lawsuits can still damage reputation and cost time

Laws vary significantly by state

Mitigation tip: Ensure the community carries adequate liability insurance and legal reserves. Seek sponsors who include insurance reviews in due diligence.

Final Thoughts

Senior housing isn’t a low-risk, hands-off asset class. But with the right structure, operator, and oversight, it can outperform more conventional assets—while delivering real social value.

| Risk Type | Key Mitigation Strategy |

|---|---|

| Regulatory Risk | Use licensed, compliant operators |

| Labor Shortages | Partner with strong HR and retention teams |

| Operator Failure | Vet deeply, track KPIs, hold accountable |

| Insurance Costs | Carry proper coverage and legal safeguards |

Trust and Oversight Matter

At Haven Senior Living Partners, we conduct detailed operational, legal, and compliance due diligence before every acquisition. Risk doesn’t scare us—but unmanaged risk is unacceptable.

See Our Risk Management Process or Contact Us to walk through a real-world example.