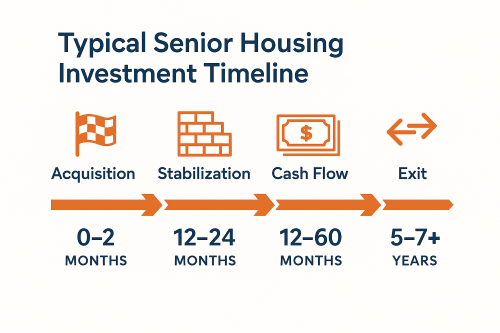

From first dollar in to final distribution.

Senior housing value-add investments offer attractive returns, but they follow a timeline that’s unique compared to other asset classes. Understanding what to expect—when returns begin, how long capital is committed, and when an exit occurs—can help investors plan better and feel more confident.

Here’s a step-by-step breakdown of the typical senior housing investment lifecycle.

Acquisition Phase (Months 0–2)

Once a property is under contract, funds are raised and deployed. This includes:

-

Finalizing capital contributions

-

Assuming or securing financing (often HUD 232 loans)

-

Transitioning operations if a new operator is involved

-

Implementing CapEx or renovation plans

This period usually results in no distributions yet, as the asset is stabilized and repositioned.

Stabilization Period (Months 1–24)

During this stage, the community is brought to target occupancy (often 85%+). Goals include:

-

Driving census through marketing

-

Increasing care level revenue

-

Optimizing expenses

-

Improving staff retention and resident satisfaction

Cash flow may begin later in this period, but some projects require reinvestment during lease-up.

Cash Flow Period (Months 12–60)

As operations improve, investors begin receiving regular distributions—typically:

-

Quarterly or monthly, depending on the sponsor

-

Based on a preferred return (often 8–9%)

-

With additional upside once the preferred return is met

These years offer consistent income while NOI is maximized.

Exit Event (Years 5–7 or beyond)

When the time is right, one of several exit strategies may be executed:

-

Sale to a REIT or institutional buyer

-

Refinance for cash-out distributions

-

Recapitalization with new investors

-

Extended hold if the property continues to perform well

Returns at exit typically include principal plus profit, generating the bulk of the total IRR and equity multiple.

Key Takeaways for Investors

-

Senior housing is not a flip—it’s a mid-to-long-term play

-

Most investments stabilize in 12–24 months

-

Regular income starts around Year 1 and continues through Year 5+

-

Your principal is usually returned at the exit event, along with profit

At Haven Senior Living Partners, we structure our investments with clear, investor-aligned timelines and communicate progress throughout the journey.

Explore Our Opportunities or Book a Call to walk through our latest deal timeline in detail.