Two paths. One goal: cash flow with impact.

Senior housing is one of the most promising real estate sectors of the next two decades. But how you participate—passively or actively—can dramatically impact your time, returns, tax exposure, and stress level.

This guide breaks down the pros and cons of each approach so you can decide what fits your strategy.

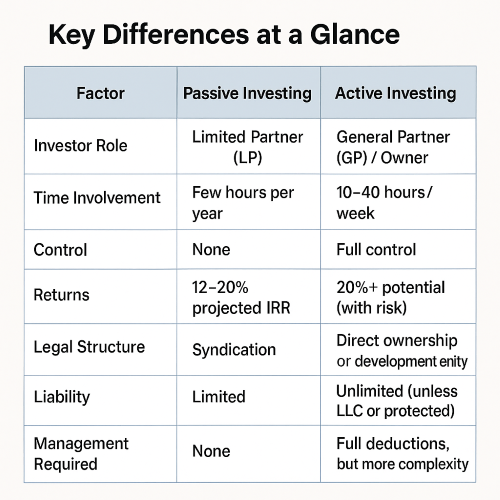

Key Differences at a Glance

| Factor | Passive Investing | Active Investing |

|---|---|---|

| Investor Role | Limited Partner (LP) | General Partner (GP) / Owner |

| Time Involvement | Few hours per year | 10–40 hours/week |

| Control | None | Full control |

| Returns | 12–20% projected IRR | 20%+ potential (with risk) |

| Legal Structure | Syndication | Direct ownership or development entity |

| Liability | Limited | Unlimited (unless LLC or protected) |

| Management Required | None | Full operational oversight |

| Tax Benefits | K-1 losses, depreciation | Full deductions, but more complexity |

Passive Investing: The LP Advantage

Who it’s for: Busy professionals, HNWIs, retirees, doctors, family offices

You invest capital into a professionally managed deal. The GP does the work; you collect distributions and a final return.

Benefits:

Set-it-and-forget-it

Diversify across operators, regions, and care types

Depreciation and passive losses can offset other passive income

Great for tax-advantaged vehicles (SDIRA, Roth, 1031 DST)

Considerations:

No control

Must trust the sponsor’s underwriting, strategy, and execution

Typically tied up for 5–7 years

Active Investing: Maximum Upside, Maximum Involvement

Who it’s for: Sponsors, developers, real estate entrepreneurs

You lead the deal—acquisition, financing, hiring staff, managing operations, and executing the business plan.

Benefits:

Direct control over every decision

Potential for promoted interest, fees, and equity upside

Customize operations and marketing

Ideal for skilled operators or vertical integration

Considerations:

High risk, high responsibility

Must manage labor, licensing, compliance, and resident care

Vulnerable to liability without proper protections

Which Is Right for You?

| If You Want… | Choose… |

|---|---|

| Freedom + passive income | ✅ Passive (LP) |

| Hands-on impact + higher upside | ✅ Active (GP/owner) |

| Tax efficiency + low hassle | ✅ Passive |

| To build an operating company | ✅ Active |

Many of our LP investors at Haven Senior Living Partners are retired executives, doctors, and professionals who’ve chosen passive syndications for long-term wealth building.

Our Investors Stay Passive—By Design

At Haven, we handle all aspects of acquisition, licensing, staffing, and resident care. Our LPs receive:

Quarterly cash flow

K-1 tax documents

Updates and financials

Capital return + profits at exit

All with no management, no tenants, no toilets.

Explore Our Investment Opportunities or Schedule a Discovery Call to learn how to add senior housing to your portfolio.