Too rich for Medicaid. Too poor for luxury. Too big to ignore.

The senior housing market is preparing for a seismic shift—and the middle market is at the epicenter. With over 14 million middle-income seniors projected by 2033, this segment is underbuilt, underserved, and full of opportunity for forward-thinking investors.

Let’s explore why middle-market senior housing is the future—and why it matters now.

Who Are Middle-Market Seniors?

These are older adults who:

-

Earn $25,000 to $75,000 annually

-

Have too much income/assets for subsidized housing

-

Can’t afford luxury senior communities ($5K–$8K/month)

-

Often rely on Social Security, small pensions, or home equity

They are the forgotten majority—priced out of high-end communities, yet unqualified for government programs.

The Demographic Data

According to NIC and NORC at the University of Chicago:

-

By 2033, there will be 14.4 million middle-income seniors age 75+

-

Over 60% of them won’t be able to afford today’s average assisted living rents

-

Yet nearly half will need some form of care or daily assistance

The gap between supply and affordability is growing fast—and most new development doesn’t address this market.

Why the Market Has Overlooked This Segment

-

Developers focus on Class A luxury for high returns

-

Middle-market margins are thinner—unless costs are managed carefully

-

Operators are hesitant due to perceived affordability barriers

Yet, those who design intentionally for this audience—smaller units, bundled services, leaner staffing models—are thriving.

Key Features of Successful Middle-Market Models

| Strategy | Description |

|---|---|

| Smaller Units | Studio and 1BR layouts with efficient design |

| All-Inclusive Pricing | Bundled rent + care + meals, simplified billing |

| Location Optimization | Second-tier markets or suburbs with low land cost |

| Lean Staff Models | Centralized care team, fewer managers |

| Value-Focused Amenities | No spas or wine bars—just the essentials |

Communities targeting this demographic often achieve high occupancy due to overwhelming demand.

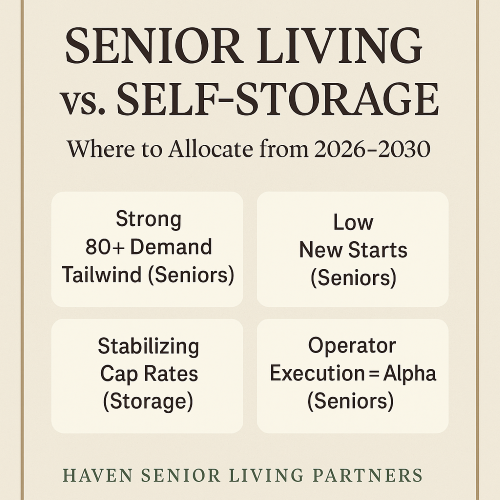

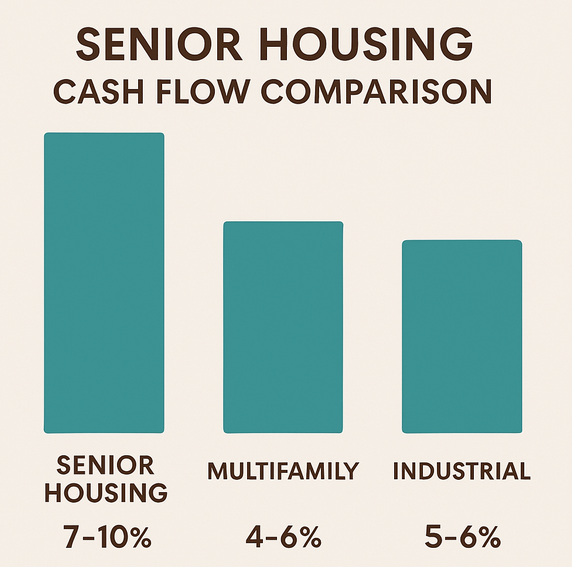

Investment Implications

| Advantage | Why It Matters |

|---|---|

| Massive Demand | Wave of baby boomers hitting middle-income bracket |

| Limited Competition | Most operators aren’t targeting this space |

| Recession Resilience | Middle-income seniors still need care, even in downturns |

| Predictable Rent Growth | Rent increases tied to inflation, not luxury markets |

Investors who build or acquire middle-market senior housing now are positioning themselves ahead of a wave that’s only beginning to rise.

Haven’s Commitment to the Middle Market

At Haven Senior Living Partners, we prioritize properties that serve this underserved group. Our acquisitions often include:

-

Modest, high-functioning communities

-

Efficient unit layouts

-

Predictable, needs-based revenue

-

Operator alignment around mission + margin

We believe this segment is where impact meets performance—and where legacy wealth can be built.

Explore Our Investment Opportunities or Book a Call to learn how you can participate in reshaping this market.