Higher complexity, higher reward.

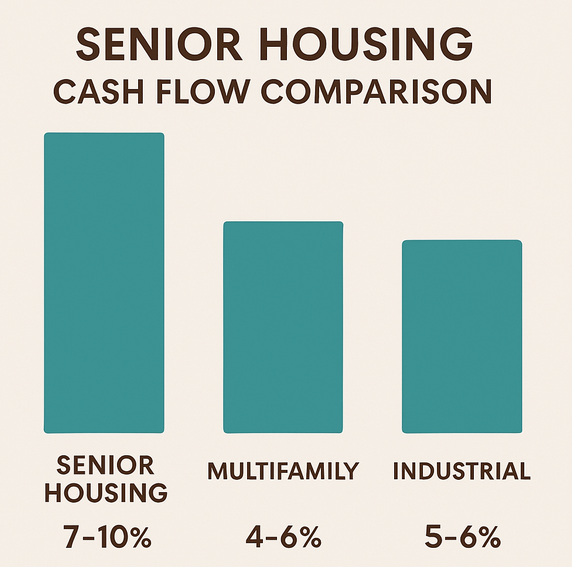

Cash flow is a top priority for real estate investors—especially those looking for consistent distributions and strong risk-adjusted returns. But how does senior housing stack up against more familiar asset classes like multifamily or industrial?

Let’s break down the numbers and explore what drives senior housing’s higher yield potential.

Cash-on-Cash Return Comparison

| Asset Class | Typical Cash-on-Cash Return | Cap Rate Range | Operational Complexity |

|---|---|---|---|

| Senior Housing | 7–10% | 6–8% | High |

| Multifamily | 4–6% | 4–6% | Moderate |

| Industrial | 5–6% | 5–7% | Low |

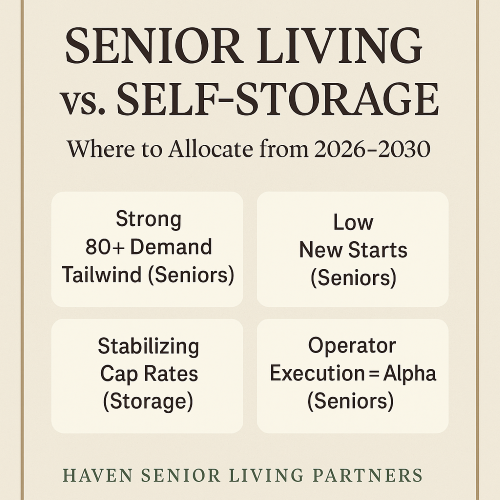

Senior housing typically outperforms on a cash-on-cash basis—thanks to higher revenue per unit, needs-based demand, and care-level billing.

What Drives Higher Cash Flow in Senior Housing?

1. Multiple Revenue Streams

Unlike apartments or warehouses, senior housing earns income from:

Rent

Meals

Personal care services

Memory care programs

Medication management

This diversification boosts revenue and reduces dependence on rent alone.

2. Stronger Resident Retention

Seniors who move into assisted living or memory care often stay for 18–24 months, sometimes longer. That means:

Lower turnover

Fewer vacancy costs

More stable income

Compare that to apartment turnover, which can exceed 50% annually in some markets.

3. Recession-Resilient Demand

Seniors move into communities based on need, not market timing. That means demand holds even in downturns—keeping NOI and distributions more stable than in discretionary sectors.

But There’s a Trade-Off: Operational Complexity

Senior housing isn’t passive. It’s operations-intensive and regulated—requiring:

Trained caregivers and clinical staff

Licensing and compliance

Resident programming and food service

That’s why experienced operators and sponsors (like Haven) are essential to unlock consistent returns.

What Does This Mean for Investors?

| You Want… | Consider Senior Housing If… |

|---|---|

| Strong quarterly cash flow | ✅ Returns matter more than simplicity |

| Predictable income in downturns | ✅ You value stability tied to need-based demand |

| Tax-efficient yield | ✅ Depreciation + cash flow = low taxable income |

| Passive involvement | ✅ You trust experienced GPs and operators |

Maximize Cash Flow with the Right Partner

At Haven Senior Living Partners, our assets are underwritten for both income and impact. Our LPs receive:

Quarterly distributions

8–9% preferred returns

Equity upside at exit

Detailed reporting and tax documentation

View Current Offerings or Book a Call to compare projected cash flow firsthand.