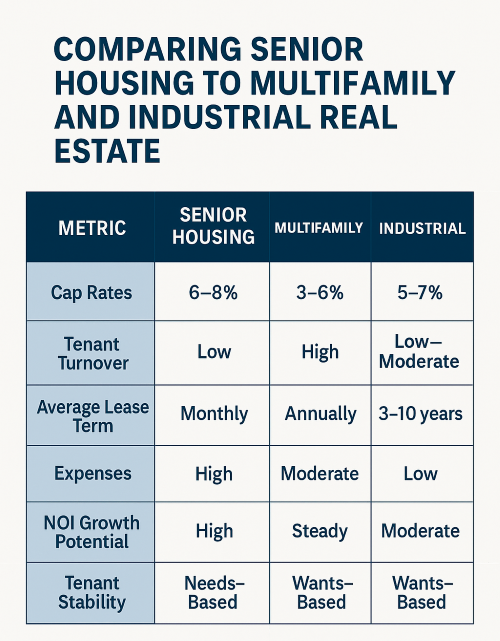

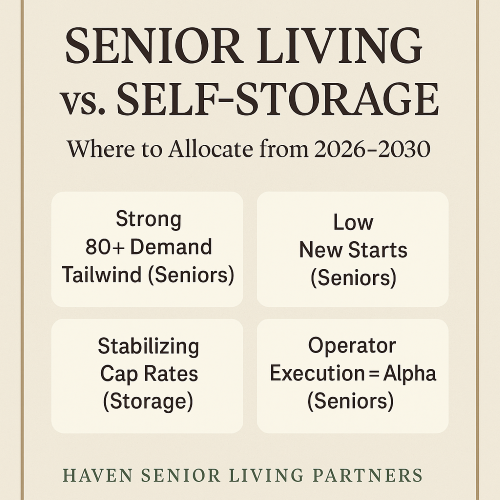

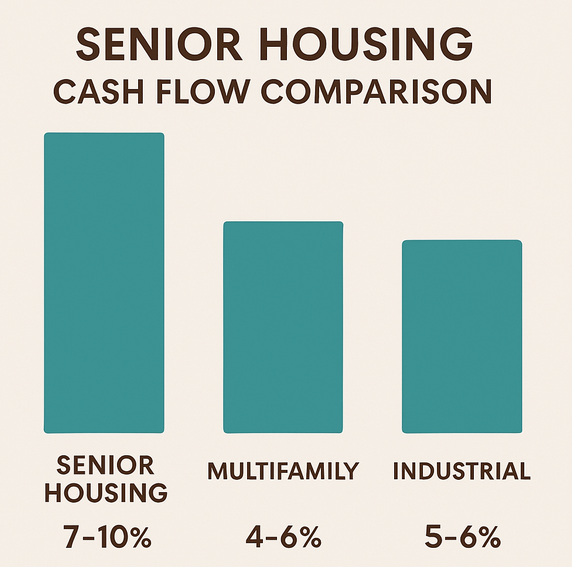

Three asset classes. One investor. Which one delivers the best long-term value?

If you’re deciding where to place your next real estate dollar, you’ve likely considered multifamily or industrial. But senior housing is increasingly entering the conversation—and for good reason. It offers both recession resilience and income potential few other asset classes can match.

Here’s a breakdown across six key investment metrics:

Quick Comparison Table

| Metric | Senior Housing | Multifamily | Industrial |

|---|---|---|---|

| Cap Rates | 6–8% | 3–6% | 5–7% |

| Tenant Turnover | Low | High | Low–Moderate |

| Average Lease Term | Monthly | Annually | 3–10 years |

| Expenses | High | Moderate | Low |

| NOI Growth Potential | High | Steady | Moderate |

| Tenant Stability | Needs-Based | Wants-Based | Wants-Based |

Senior Housing: The Needs-Based Outperformer

Senior housing serves a demographic that must have care—whether markets are up or down. Unlike retail or industrial, demand is driven by life stage, not economic cycle.

Higher Cap Rates mean stronger yield out of the gate

Sticky tenants with low turnover due to medical need

NOI can grow significantly through care level adjustments and rent increases

The tradeoff? Higher operational complexity and regulatory oversight.

Multifamily: The Familiar Favorite

Multifamily is the go-to for many real estate investors. It’s simple, proven, and stable—until it isn’t.

Rents reset annually, giving room for inflation alignment

High competition and compressed cap rates reduce yield

Rent control and regulatory changes can threaten upside

Multifamily performs well, but faces market saturation in many urban areas.

Industrial: The Rising Star (With Limits)

Industrial has surged due to e-commerce and just-in-time logistics. It offers long leases and low management.

Creditworthy tenants (e.g., Amazon, FedEx) reduce default risk

Long lease terms smooth income

But: Supply is increasing, and rent bumps are modest

Most investors use industrial as a stable, long-term hedge—not a yield engine.

What Should Drive Your Decision?

| If you want… | Consider: |

|---|---|

| High yield and demographic tailwinds | ✅ Senior Housing |

| Simplicity and low barrier to entry | ✅ Multifamily |

| Long leases and low-touch management | ✅ Industrial |

For investors who can partner with experienced operators and understand care-based real estate, senior housing offers both mission and margin.

We Help You Invest Where the Demand Is

At Haven Senior Living Partners, we help accredited investors access institutional-grade senior housing investments—without the complexity of operations or development.

Explore Our Current Offerings or Contact Us to learn how to build a balanced real estate portfolio with senior housing as your foundation.