Japan’s Rate Shock and What It Means for Commercial Real Estate

Japan’s 20-year bond yield jumping to 2.75% marks the end of the 30-year era of ultra-cheap money that quietly powered global real estate, stocks, and credit. For commercial real estate investors, this isn’t just a headline—it’s a structural reset of funding costs, asset values, and opportunity.

1. Higher U.S. Borrowing Costs → Refinancing Risk Explodes

As Japan repatriates capital and reduces its exposure to U.S. Treasuries, U.S. borrowing costs drift higher—regardless of what the Fed says. Even a 30–50 basis point rise in the real cost of capital:

- Pushes cap rates up 50–100 bps, especially in over-valued, core markets.

- Makes bridge, construction, and floating-rate debt far more painful.

- Turns the 2025–2027 “refi wall” into a real stress test for leveraged owners.

Borrowers face lower proceeds, stricter DSCR tests, and more lender scrutiny, forcing equity infusions, recapitalizations, or outright sales.

2. Liquidity Pullback as Japanese Capital Steps Back

Japanese banks, life insurers, and institutions have been meaningful participants in global CRE debt and credit markets. As yields rise at home, their incentive to fund U.S. real estate shrinks.

- Less appetite for CMBS, mezzanine, and construction loans.

- Reduced allocations to real estate debt funds and private credit.

- Higher spreads and fewer creative capital solutions for transitional assets.

The practical outcome on the ground: deals that penciled at 2021 capital costs no longer work. Only the cleanest, best-sponsored projects clear investment committee.

3. Cap Rate Expansion and Asset Repricing

A structurally higher global rate environment means investors will not accept yesterday’s cap rates. Over the next 12–24 months, expect:

- 75–150 bps cap rate expansion in many markets, especially for core and core-plus assets.

- 15–30% valuation compression where cap rates were artificially tight.

- Ongoing bid-ask spread as sellers anchor to old values and buyers price in new realities.

Transaction volumes remain muted until price discovery is forced by loan maturities, fund redemptions, and distress.

4. Carry Trade Unwind → Market Volatility and Redemption Pressure

As the yen carry trade unwinds—borrowing cheap yen to fund stocks, crypto, and risk assets—global markets feel the whip. A weaker equity tape and margin calls mean institutions seek liquidity wherever they can find it.

- Open-end funds and REITs face redemption pressure.

- New CRE fund commitments slow or pause.

- Managers sell assets not because they want to—but because they have to.

This is how “macro” becomes “property-level”: solid assets in good markets come to market at discounts to satisfy investors’ need for cash.

5. Japanese Buyers Retreat from U.S. CRE

Decades of low yields turned Japan into a steady source of capital for U.S. trophy and core real estate. With rising domestic yields and higher hedging costs:

- Japanese buyers’ ability to pay premium pricing is reduced.

- $200M+ assets lose a key buyer cohort.

- Middle Eastern and Asian capital may step in, but more selectively and at higher yields.

That means fewer “last-bidder-standing” situations and more rational pricing, especially at the top end of the market.

6. Construction Costs and New Supply

Higher global rates and currency volatility filter into construction costs through:

- More expensive imported materials and equipment.

- Rising financing costs for developers and contractors.

- Tighter underwriting for new development loans.

The result: projects are shelved, pipelines thin out, and future supply is constrained—a powerful long-term tailwind for existing, well-located assets.

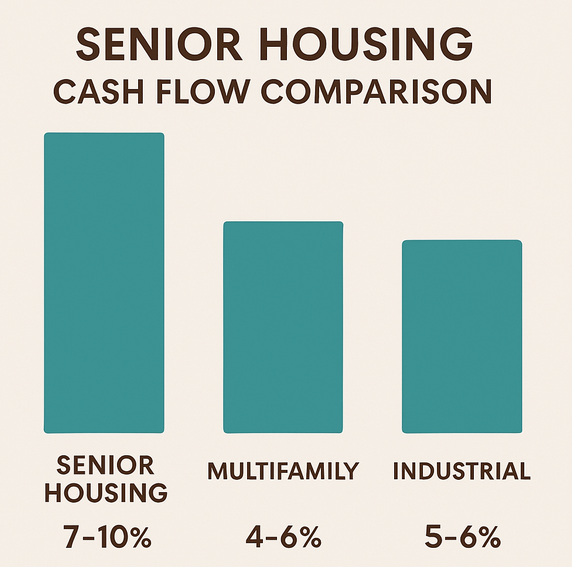

7. Senior Housing: A Special Case in This Reset

Senior housing sits at the intersection of demographic inevitability and capital scarcity. In a Japan-driven rate reset:

- Cap rates for acquisitions rise 50–75 bps in the near term.

- Construction financing becomes more selective, slowing new builds.

- Older, operationally weak properties face pressure at refi, creating value-add opportunities.

Over the next decade, chronic underbuilding and aging populations mean that today’s well-located, well-operated senior communities stand to benefit from stronger rent growth, higher replacement costs, and increasing scarcity value.

8. Timeline: Short-, Mid-, and Long-Term Effects

Higher borrowing costs, muted transaction volumes, tougher refis, and more selective lending.

- Floating-rate pain accelerates.

- Bridge and construction loans reprice.

- Bid-ask spreads remain wide.

Cap rates reset, funds face redemptions, and distressed or motivated sales increase.

- Best assets with bad capital stacks come to market.

- Value-add and opportunistic capital steps in.

- Senior housing, industrial, and necessity-based assets gain favor.

Less new supply, higher replacement costs, and demographic demand drive long-term NOI growth.

- Strong operators consolidate weaker peers.

- Senior housing and needs-based sectors outperform.

- Assets bought in the reset vintage become legacy winners.