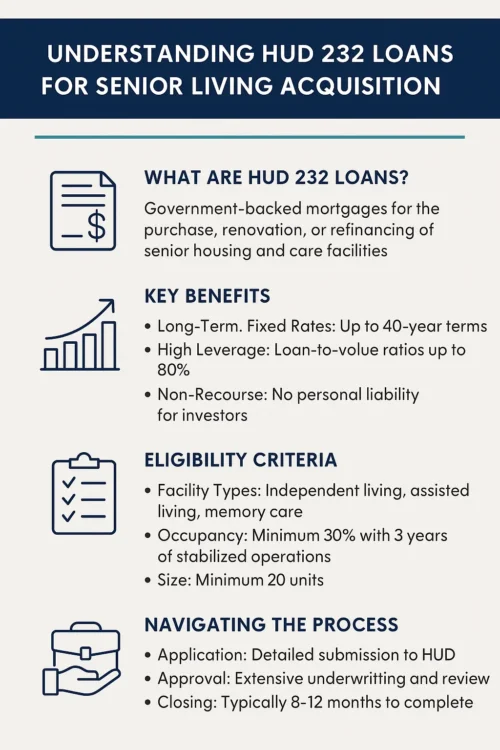

Your guide to one of the most powerful—and underutilized—tools in senior housing finance.

When acquiring or refinancing a senior living community, few options compare to the HUD 232 loan. With fixed interest rates, long amortization periods, and non-recourse protection, this FHA-backed mortgage product has become a go-to solution for experienced senior housing investors.

Let’s break it down.

What is a HUD 232 Loan?

The HUD 232 loan is a mortgage insurance program administered by the Federal Housing Administration (FHA) specifically designed for senior care facilities. It provides long-term, fixed-rate financing for:

Acquisition

New construction

Rehabilitation

Refinancing

The program is targeted at facilities offering assisted living, memory care, skilled nursing, or board-and-care services.

Why Investors Love It

Here are the major advantages:

✅ Long-Term Fixed Rates

Terms up to 40 years (plus construction if applicable)

Fixed rates help with predictability and cash flow planning

✅ High Leverage

Up to 75% loan-to-value for acquisitions

75%+ for new construction and substantial rehab

✅ Non-Recourse

No personal liability for the borrower (beyond standard bad acts)

✅ Assumable Loan

If you sell, the buyer can assume the low-rate loan—extremely attractive in today’s high-rate environment

✅ Interest Rate Protection

FHA-insured debt is often tied to GNMA securities, making it more stable than private lending options

Which Properties Qualify?

To be eligible for HUD 232 financing, your facility must meet certain criteria:

| Requirement | Details |

|---|---|

| Property Type | Assisted living, memory care, or skilled nursing |

| Stabilization | Typically 3+ years of operating history preferred |

| Occupancy | Minimum 30% at application; 85%+ recommended for best terms |

| Unit Count | Minimum 20 licensed beds |

| Licensing | Must be state-licensed and compliant with health regulations |

Application & Approval Process

HUD 232 loans are rigorous—but worth it.

Steps include:

Engage a HUD-approved lender

Preliminary underwriting

Environmental, appraisal, and market study

FHA application and commitment issuance

GNMA securitization and closing

The process can take 8–12 months, so it’s best for strategic investors with patient timelines and a long-term view.

Strategic Uses

Stabilized acquisitions with an assumable 2–4% HUD loan rate are ideal.

Refinance higher-interest bridge or private loans.

Development with built-in long-term financing from day one.

HUD loans are especially appealing during rate-tightening cycles, as they lock in low-cost, government-backed capital for decades.

What to Watch Out For

While attractive, HUD 232 loans are not for every situation. You’ll need to:

Be comfortable with a longer closing timeline

Maintain regulatory compliance

Work with experienced advisors, consultants, and legal counsel

But for qualified investors, the rewards—stability, leverage, and security—are unmatched.

Want to See a HUD 232 Deal in Action?

At Haven Senior Living Partners, we specialize in acquiring and repositioning senior housing communities with assumable HUD 232 financing in place. Our most recent offering includes a 2.46% HUD loan already approved for transfer.

Book a Consultation to learn how HUD 232 can boost your returns and lower your risk.